how are rsus taxed in india

Pay income tax after adding such shares to taxable income. Capital Gains Tax on RSUs on stocks listed in US.

A Guide To Restricted Stock Units Rsus And Divorce

Answer 1 of 3.

. RSU taxation in India. I have RSU as part of my compensation. If you have received restricted stock units RSUs congratulationsthis is a potentially valuable equity award that typically carries less risk than a.

How are ESOPs RSUs taxed in India. This is true whether were talking about. This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options are exercised.

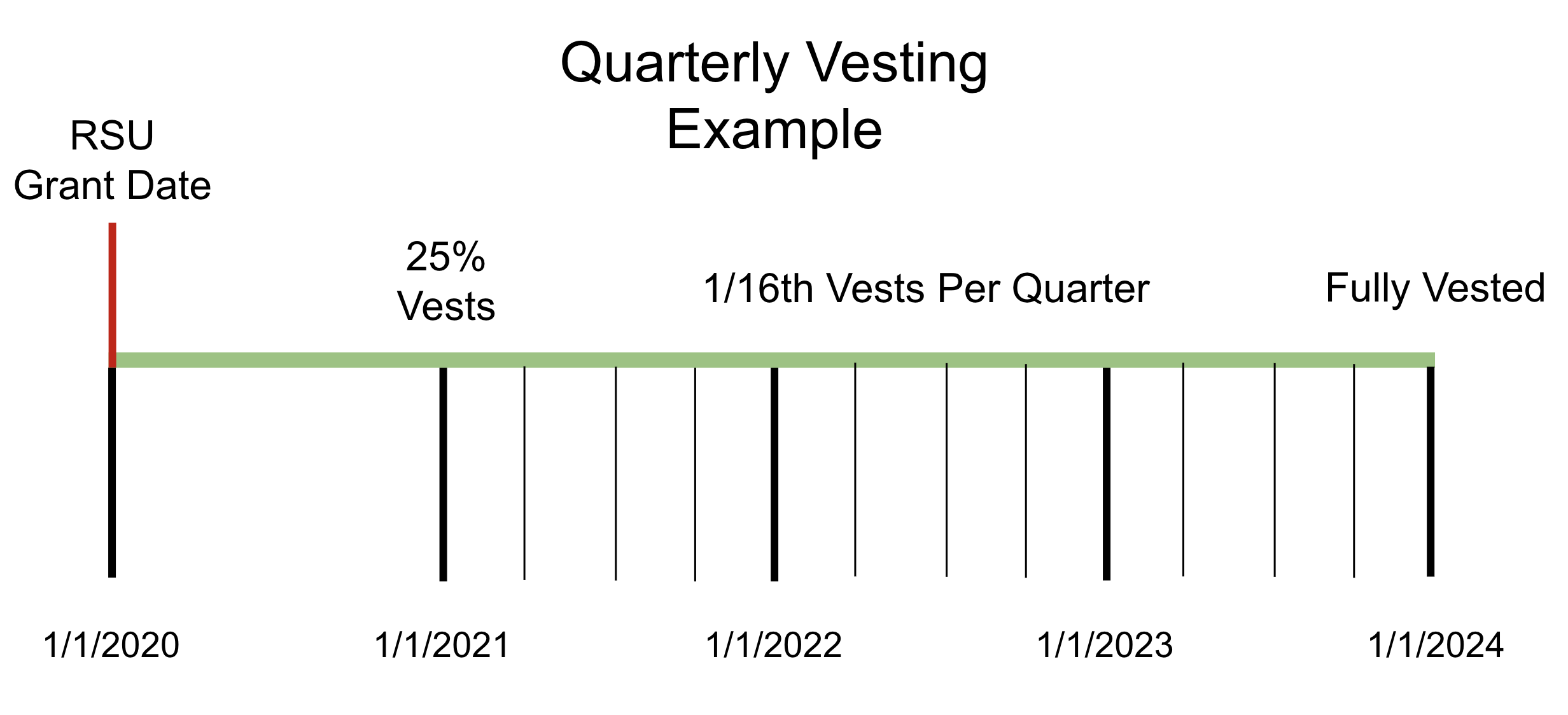

As the name implies RSUs have rules as to when they can be sold. Selling RSUs within 2 years of acquisition. The capital gains tax rate when you sell the shares you own.

How your stock grant is delivered to you and whether or not it is vested are the key factors. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock. Restricted stock and RSUs are taxed upon delivery and subject to progressive income tax up to 56 percent.

Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained. If you hold the RSUs for more than 3 three years than the entire amount of sale proceeds will be. In fact there are only two rules viz.

In such a situation where an employee exercise shares under an RSU he needs to pay tax on the perquisites in the foreign country ie the country in which the taxable RSU perquisite arises and claim a foreign tax credit in India against the income chargeable to tax in India. The Company I work for has its stock listed in US markets. That would occur under the scenario I outline below.

What about tax withholding on my RSU income. This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers. Hi Im a Resident of India working for MNC.

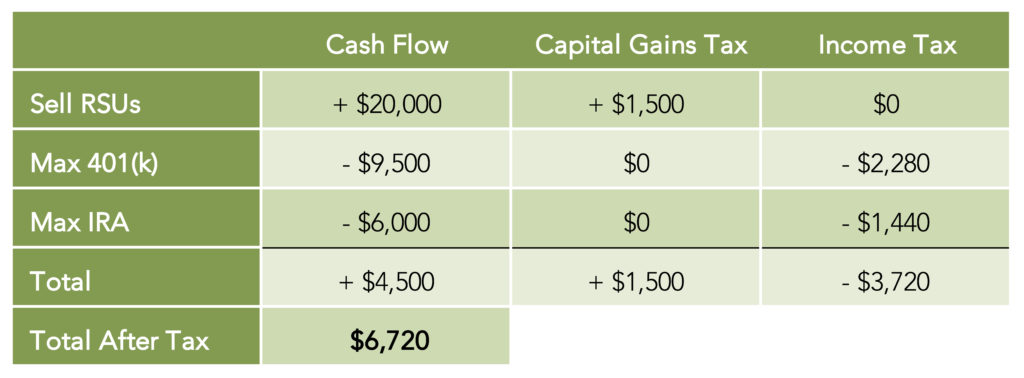

For Taxes to be paid in India. Most companies dont withhold taxes according to your W-4 rate but will instead use the flat IRS rate for supplemental wage income. How Are Restricted Stock Units RSUs Taxed.

When RSUs become vested Fidelity the plan sponsor sells some of the taxes to take care of the taxes employees would owe on the new compensation. RSU Taxes Explained. If this isnt correct then please add some clarification of.

Tax to be paid in India. Tax Implications of Restricted Stock Units. RSU Withholding Rate A Common Confusion.

Microsoft RSU vest four times a year. On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers. Foreign RSUstock tax calculator.

How much tax is to be paid by you depends on the nature of the gains. Stock grants often carry restrictions as well. So RSUs are taxed twice.

Taxability on acquiring ownership. With RSUs you are taxed when you receive the shares. Its important to remember that the RSU tax rate will be the same as your income tax rates.

Here is an article on employee stock options. When you sell the your RSUESOPESPP after vesting period is over and get back the money its your responsibility to pay the tax on the amount in India. Since the ownership of these valuable shares comes free of cost or at a nominal price it is a considered as an employment perk or a perquisite in taxation terminology.

RSU Tax Rate vs. RSUs Restricted Stock Units are a big part. By Aditi Bhardwaj May 16 2021 May 16 2021 0 532.

I assume that the broker acted correctly which in turn indicates that the income from the vesting of the RSUs is taxable in both the US and India. Ryan McInnis founded Picnic Tax after working for more than a decade at some of the financial services industrys leading firms. However on received the stocks 20 of it 10 shares were deducted as taxes towards the US government.

Am I getting double taxed in India for the RSUs that are listed on Nasdaq. Selling RSUs later than 2. RSUs can also be subject to capital.

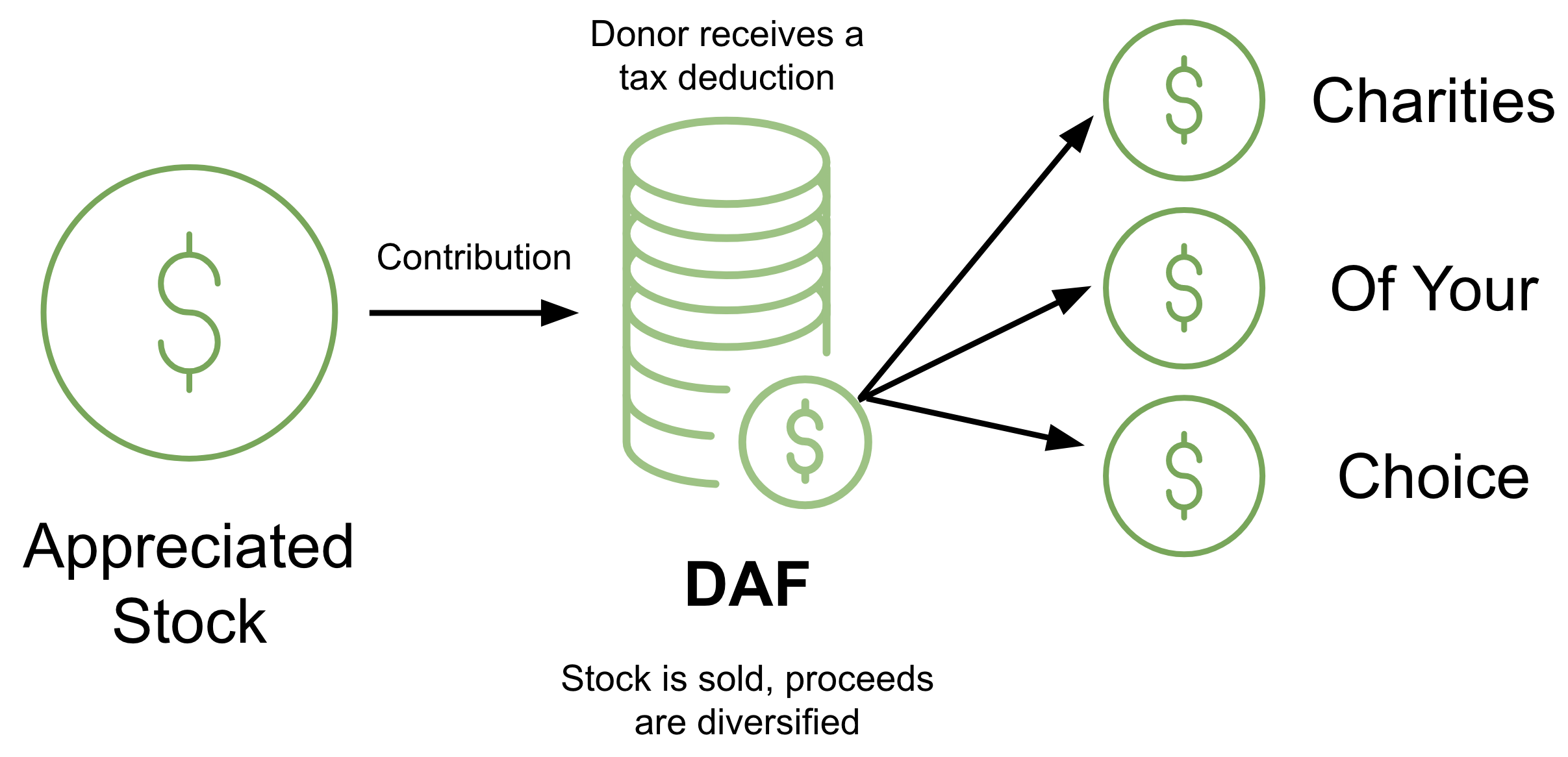

The gain from the sale of shares is subject to tax as capital income at 30 percent up to EUR30000 and 34 percent for the exceeding part. Foreign tax credit FTC is a non-refundable tax credit for. The rules that govern the taxation of ESPP ESOP and RSUs are the same as they all deal with stocks that an employee receives and the taxation rules are also fairly easy to understand.

Taxes to be paid in India and stocks listed on foreign exchanges. This year when my RSU stocks vested stocks were sold to cover taxes. I see that the foreign brokerage firm sells 30pct of the grant in USD when vested and tax again gets deducted in INR for the grants.

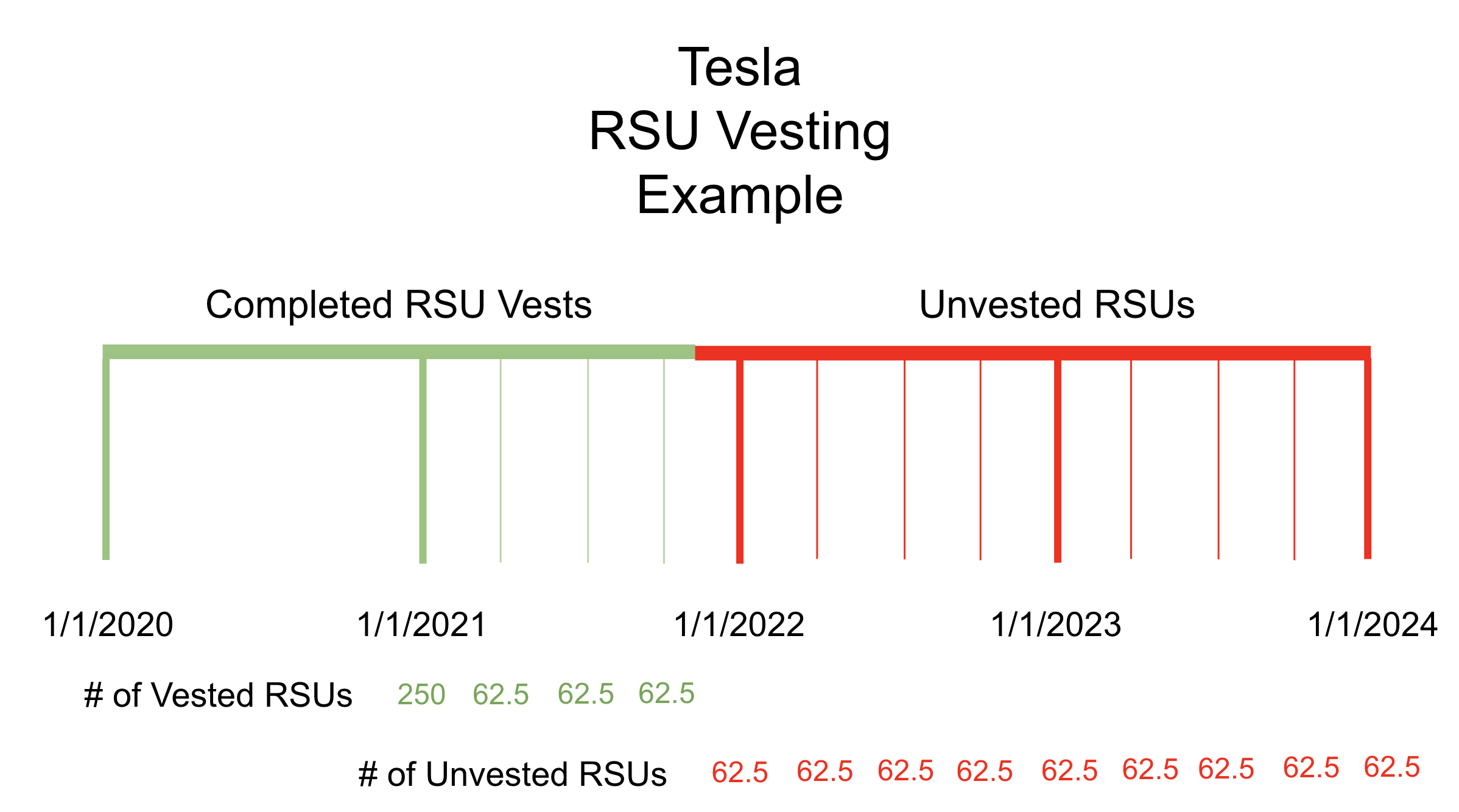

RSUs vest over time but employees receive the RSUs upon being hired or as a bonus. I was previously employed at EA Games India Hyderabad where I received 50 RSUs of Electronic Arts Inc. Picnics goal is to make tax filing simpler and painless for everyday Americans.

Answer 1 of 2. Since in your case the RSUs are listed on NASDAQ and not on any Indian Stock Exchange they are unlisted securities wrt Indian Direct Tax law. Restricted stock units RSUs and stock grants are often used by companies to reward their employees with an investment in the company rather than with cash.

The loss from the sale of shares can be carried forward up to 5 years. Your taxable income is the market value of the shares at vesting. Sale value added to income tax amount and taxed as per applicable slab.

The ordinary earned income tax rate when the RSUs vest or. Business Finance Income Tax. For 2021 that rate is 22 on supplemental wages up to 1 million and 37 for wages in excess of 1 million.

RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. I have signed w8ben treaty through by trading partner account to avoid double taxation. About 6522 value is consumed in tax.

Indian company also has calculated perquisite based on FMV on total number of stocks including withheld stocks and properly deducted TDS 309 and remitted the TDS and issued Form 16 for FY2018-19 and it is properly reflecting in Form 16 Part A and Part B. Please note that if your RSU income is taxed above 22 when your taxes.

How To Avoid Taxes On Rsus Equity Ftw

How Are Esops Rsus Taxed In India Aditi Bhardwaj Co

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

What Happens To Rsus When You Quit Equity Ftw

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Stock Options Vs Rsus What S The Difference Thestreet

What Is A Restricted Stock Unit Rsu Everything You Should Know Carta

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Income Tax Implications On Rsus Or Espps

Restricted Stock Units Rsus In Friendly Terms Part 2 Of Equity Compensation Taxes Youtube

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

What Happens To Rsus When You Quit Equity Ftw

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Understanding Rsu Esops Espp Tax Implications Mymoneysage Blog

Rsus Vs Stock Options Intel And Airbnb Executive Compensation Workspan Magazine Workspan By Worldatwork